Customer satisfaction within the banking, insurance and collection industries is low and not improving. What are the issues and how can they be addressed?

Given this new criteria, sensationalist headlines proclaiming ‘record numbers of complaints’ weren’t accurate – in fact, using the same measurements as 2016 H1, complaints actually decreased by approximately 14%.

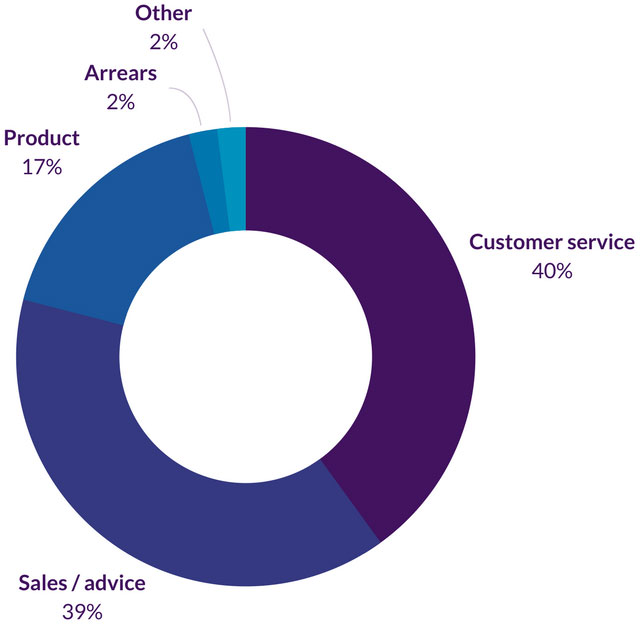

However, excluding PPI, there were still 2.15 million complaints in six months, and of those, 40% related to general admin / customer service, and 39% to advising, selling and arranging of products.

This dissatisfaction isn’t unique to the UK: in a 2016 US based survey conducted by the Better Business Bureau, two of the top 10 most complained about industries were collection agencies (position five on the list, with 8% of all complaints) and banking (position nine, with 6% of complaints).

Add to this the context of an environment where, regardless of your company size and industry, 85% of your customers are measuring your customer experience against the best in the world (think Amazon, Netflix and Starbucks), and it’s reasonable to suggest that the financial services industry needs to address its customer service challenges.

What’s wrong with customer service in the financial services industry?

We can start with responsiveness. Eptica’s 2015 Customer Experience study evaluated insurers’ ability to provide answers to ten routine customer questions, asked across four channels (via information on the website, email, social media and chat). On average, only four out of 10 questions were successfully answered, and 20% of insurers failed to provide any answers at all. As the study authors point out, given the ease of switching to an alternative service provider, this is a high-risk approach.

We can also view complaint handling. The UK Customer Satisfaction Index has been tracking customer satisfaction across multiple sectors for the last eight years, and in July 2017, reported a 13.8% increase in the number of escalated complaints to Banks and Building Societies from 2016 to 2017.

There’s a similar story in Insurance, which has seen a 7.8% increase, taking the per cent of escalated problems in this sector to 55.2%. That’s over half of all problems reported being escalated.

What can be done to put it right?

According to the UKCSI, the difference between the companies blazing trails in delivering exceptional customer service and everyone else comes down to three key areas:

- Complaint handling: staff doing what they say they will do

- Over the phone: the ease of getting through, and the helpfulness and competence of staff

- First Contact Resolution: Gartner reports that 52% of total inbound calls are not resolved in one call.

These are all contact-centre agent focused, which presents its own set of challenges, in that a Toister survey from 2016 found that 74% of agents are at risk of burnout.

Further, although the telephone remains the most popular customer service channel, it’s also the most frustrating, with long delays before connection, calls not being returned, and staff unable to resolve the query once you do get through.

Can self-serve technology address some of these challenges?

For younger generations, self-serve is preferable to speaking to an agent – a Parature survey found that 34% of millennials (born after 1980) would rather have their teeth cleaned than pick up the phone to a call centre.

Self-serve in the classic sense of the term refers to customers proactively completing actions on your website or app. But a broader definition includes any communication with your company in which the customer is in control.

For example, an SMS chat platform which allows your customers to text queries into agents, receive responses, and reply when is convenient for them is preferable to having to wait on hold.

This benefits both the customer and the financial services provider, as agents can handle multiple text conversations whereas they can only manage a single telephone call – and because a record is kept of the messages on both sides, it’s effective from a compliance and training perspective.

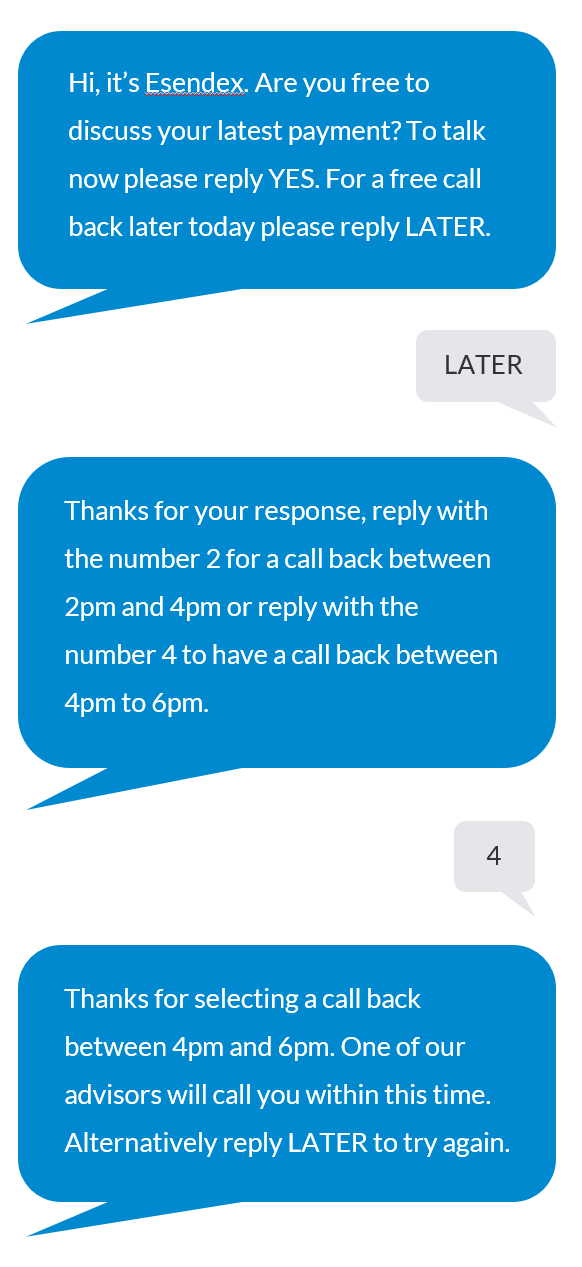

A text-to-callback function which allows customers to text your company to request a call might not, on the face of it, sound like a time-saving exercise, as an agent will need to be available to make the call.

However, an automated response giving the customer the ability to pick a time slot allows you to choose periods where your agents are typically more available to make calls, creating value on both sides.

AI has an increasingly important role to play

Chatbots have evolved beyond a basic input > output solution with pre-defined answers to AI-driven platforms utilising Natural Language Processing (NLP) to provide detailed, accurate responses to almost any question.

A report from [24]7 found that 39% of consumers are willing to have automated conversations with chatbots, and this is likely to grow as the technology becomes more familiar.

To conclude, it’s worth repeating this Forrester Research statistic: 77% of people say that valuing their time is the most important thing a company can do to provide them with good service.

Value your customers time by giving them more control over interactions, and you’ll be on the way to better customer retention and a true competitive advantage. Take a look at our free customer service ebook for some more fantastic stats and ideas.