Collecting debt in the utility sector can often lead down dead-ends, resulting in millions of pounds being written off. Here’s how an automated debt collection strategy can help recoup more of this debt.

One of the key challenges for utility providers in recent years has been recouping debt owed by their customers.

Although the utility sector is moving in the right direction when it comes to reducing the amount of customers in debt, the amount owed by the average customer in debt grew to over £600 in 2017 before they started making repayments. This is a 7% increase on 2016 figures (Source).

One of the main issues is that often the customer has moved home without settling their account, meaning that regardless of how many communications are sent, the customer will never read them – or make a payment.

Another problem is that the cost of chasing debt (when considering the cost of making calls and sending paper letters) is often greater than the level of debt owed.

What is intelligent multichannel and how can it help in the utility sector?

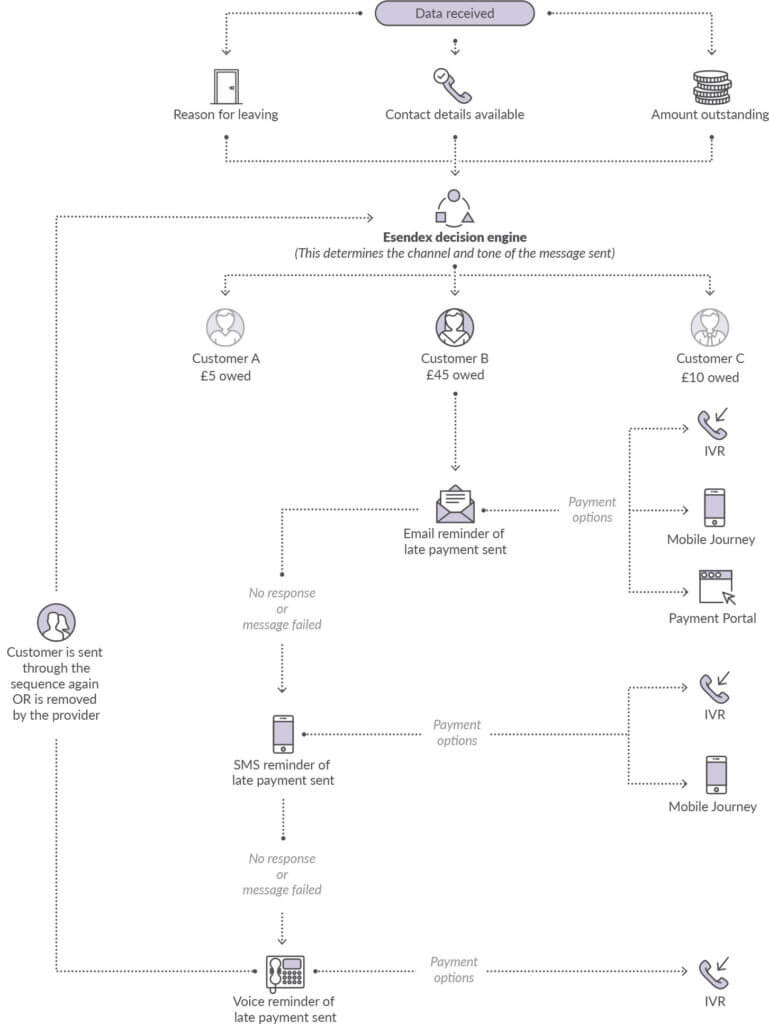

With intelligent multichannel, customer data is used to automatically create tailored communication strategies for each customer in debt. Any combination of data can be used to personalise and sort messages into the channels which best improve the chances of a customer taking the desired action – such as the age and value of the debt, and the contact details held for the individual.

Then, based on your customers’ interaction with sent messages, we can set up a “decision engine” which determines the subsequent type of response and the channel to use.

Intelligent multichannel also provides the following benefits for utility providers and their customers:

- Promotes friendly, fair, non-intrusive customer contact

- Self-serve technology which adds convenience to the customer, and reduces the cost to serve

- Reduces reliance on outbound activity from call-centre resource

- Provides the ability to switch between communication channels as required.

What does an intelligent multichannel strategy for utility collections look like?![]()

Intelligent multichannel starts by taking the communication channels which can prompt payment in the most effective and engaging ways. Channels like SMS, Email, automated outbound voice, and mobile web apps are some of the channels which, when combined with bespoke decision engines, will automatically determine the best ways to contact each customer.

Here is just one example of how an intelligent multichannel strategy could look for chasing debt in an automated and cost-effective way.

What are the benefits utility providers can expect to see?

Obviously, every case is different, but after working closely with the team at npower to develop an appropriate strategy for their customers, the following benefits were seen:

- 19% of customers approached for payment through the multichannel workflow made a payment, compared to 4% with the previous workflow which used traditional channels like post and outbound calls

- 82% of payments were for the full amount owed

- When compared to the cost of sending a paper letter, notification of overdue payment through SMS was 16%, Email 1%, and automated voice 50%.

- Receiving a payment through the multichannel platform costs just 30% of the cost of receiving a payment via a call.

So what are the next steps?

If you’re interested to know more about how an intelligent multichannel strategy can help utility providers, and how Esendex can make the process work more effectively for you, please get in contact with our team today on 0345 356 5758 or email us at [email protected].

You can also take a look at our free mobile payments ebook for some more fantastic stats and ideas.